Schaeffler Group

Schaeffler is at a turning point: the transformation into a ‘motion technology company’ through the Vitesco merger offers enormous potential, but high debt and integration risks make the share a ‘show-me’ story whose success depends on synergies and the ramp-up of e-mobility.

Summary

Schaeffler Technologies AG & Co. KG, also known as the Schaeffler Group, is a perfect example of how an industry can change. It is going through a difficult change from mechanical combustion systems to mechatronic electrification systems. After the historic merger with Vitesco Technologies Group AG in late 2024, the company became a "Motion Technology Company" with annual revenues of more than €25 billion and a workforce of about 120,000 people. The company makes money through four main business units: E-Mobility, Powertrain & Chassis, Vehicle Lifetime Solutions (Aftermarket), and Bearings & Industrial Solutions. Schaeffler is at a delicate turning point in terms of its economy. Even though it has successfully diversified its top line away from the internal combustion engine (ICE), the high costs of this change, along with the costs of integrating Vitesco (€580 million one-time restructuring impact), and a European industrial economy that isn't growing, have put pressure on free cash flow and leverage ratios in the short term.

The company’s competitive advantage resides in its "system understanding"—the newly acquired ability to integrate Schaeffler’s mechanical precision (bearings, transmissions) with Vitesco’s electronic control units and software, creating optimized electric powertrains that pure-play mechanical or electronic competitors struggle to replicate. However, the risks are pronounced. The company is currently rated BB+ with a negative outlook by S&P, reflecting a balance sheet stretched by the merger and a reliance on significant synergy realization (€600 million annually by 2029) to restore investment-grade metrics. Furthermore, with approximately 20-25% of revenue exposed to Greater China, Schaeffler faces acute geopolitical tail risks amidst escalating trade tensions. Schaeffler is currently a "show-me" story for investors. It is a highly leveraged turnaround play with a lot of upside potential if the synergies and E-Mobility ramp-up go well in 2026-2027. However, it also has the structural problems of an old industrial conglomerate in a capital-constrained environment.

1. What They Sell and Who Buys It

Core Product Portfolio and Technological Synergies

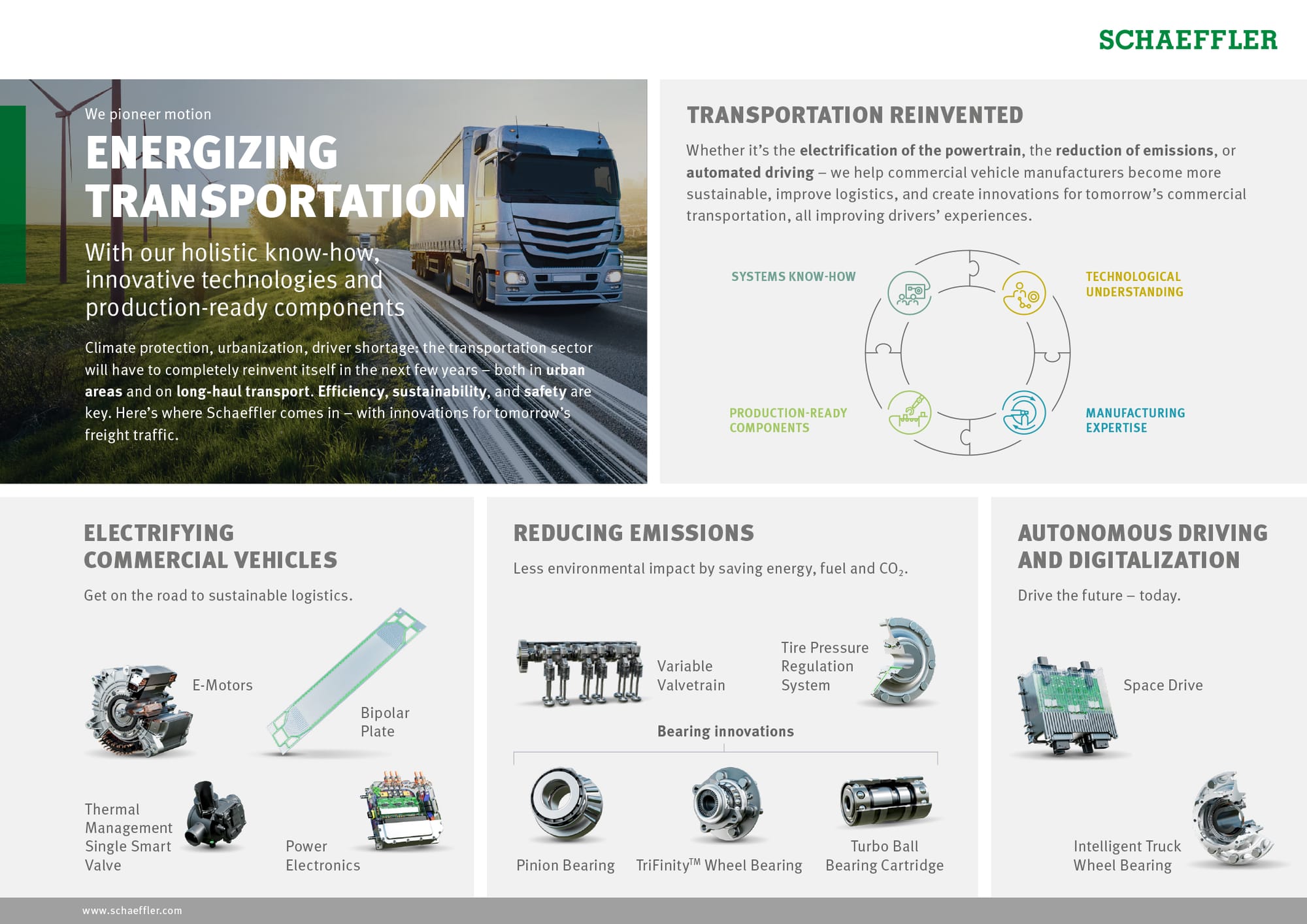

The strategic architecture of Schaeffler Group has been fundamentally redrawn to address the electrification of motion. No longer merely a supplier of high-precision metal components, the post-merger entity sells complex, integrated systems that govern motion in vehicles and industrial machinery. The portfolio is segmented into four distinct divisions, each addressing specific technological imperatives.

E-Mobility: The Strategic Vanguard

The E-Mobility division is the primary locus of future value creation and the direct beneficiary of the Vitesco integration. The product suite here is comprehensive, targeting the entire energy flow from the battery to the wheel.

- Electric Axle Drives (E-Axles): These are 3-in-1 or 4-in-1 systems integrating the electric motor, transmission (reducer), power electronics (inverter), and thermal management into a single compact unit. Schaeffler’s value proposition is the optimization of the interface between these subsystems—for instance, using Vitesco’s control software to modulate Schaeffler’s mechanical transmission to maximize range and minimize noise, vibration, and harshness (NVH).

- Power Electronics & Battery Management: Critical components such as high-voltage inverters, DC/DC converters, and Battery Management Systems (BMS) are now core offerings. These products manage the flow of electrical energy, a capability Schaeffler lacked prior to the merger.

- Thermal Management: With the rise of EVs, thermal management has evolved from simple engine cooling to complex integrated thermal management modules (ITMM) that regulate battery temperature to optimize charging speed and lifespan.

Powertrain & Chassis: The Cash Harvest Engine

Despite the focus on EVs, the Powertrain & Chassis division remains the volume anchor, selling essential components for internal combustion engines (ICE) and hybrid architectures.

- ICE Components: Variable valve train systems, camshaft phasing units, and belt drive systems. While the market for these is shrinking structurally, Schaeffler maintains a dominant market share, using pricing power in this consolidating niche to harvest cash.

- Chassis Systems: This segment is pivoting toward autonomous readiness with steer-by-wire systems and electromechanical actuators for active roll stabilization (iARC). These mechatronic systems replace hydraulic predecessors, offering better integration with vehicle software architectures.

Vehicle Lifetime Solutions (Aftermarket): The Profit Stabilizer

This division packages OE-quality components into repair solutions for the independent aftermarket (IAM).

- Repair Kits: Instead of selling a single bearing, Schaeffler sells "LuK RepSets" (clutch kits), "INA FEAD Kits" (Front End Auxiliary Drive), and "FAG WheelSets." These kits include every bolt, washer, and component required for a specific repair, solving a complexity problem for the mechanic.

- Digital Services: Through platforms like REPXPERT, Schaeffler sells data and service instructions, increasingly monetizing the "know-how" of repair alongside the hardware.

Bearings & Industrial Solutions: The Diversified Industrial Base

This division serves a broad spectrum of non-automotive sectors, providing rolling and plain bearings ranging from microscopic dental drill bearings to multi-ton wind turbine main shafts.

- Renewables: Main shaft and gearbox bearings for wind turbines.

- Aerospace: Jet engine bearings and helicopter components.

- Industrial Automation: Linear guidance systems and mechatronic actuators (bolstered by the Ewellix acquisition) for robotics and factory automation.

Target Customers and Purchase Motivations

Schaeffler’s customer base is bifurcated between highly concentrated global OEMs and a fragmented industrial/aftermarket network.

Automotive OEMs (Original Equipment Manufacturers):

- Segments: Passenger cars, light commercial vehicles, and increasingly heavy-duty trucks. Key clients include Volkswagen Group, Stellantis, BMW, Ford, and Chinese champions like BYD and SAIC.

- Motivation: In the ICE era, OEMs bought components to assemble engines themselves. In the EV era, OEMs are increasingly capital constrained and engineering resource-limited. They buy from Schaeffler to access "black box" competence—purchasing a complete E-Axle because developing one in-house would divert resources from software and brand differentiation. Reliability is paramount; a failure in a €50 bearing that grounds a vehicle is unacceptable.

Industrial OEMs and Operators:

- Segments: Wind farm operators (e.g., Vestas, Goldwind), Aerospace manufacturers (Boeing, Airbus, GE Aviation), and machine tool builders.

- Motivation: Total Cost of Ownership (TCO). A wind farm operator buys premium FAG bearings not for the upfront price, which is higher than Chinese competitors, but for the assurance that the turbine will not require a €200,000 offshore crane repair operation due to premature bearing failure.

Aftermarket Distributors:

- Segments: Major international trading groups (e.g., ATR, TEMOT) and online wholesalers.

- Motivation: "Convenience" and Brand Trust. Distributors prioritize fill rates and inventory turnover. They buy Schaeffler kits because the brand pull is strong with mechanics—installing a trusted LuK clutch ensures the mechanic doesn't face a warranty claim from their customer.

2. How They Make Money

Revenue Model and Pricing Architecture

Schaeffler operates primarily on a highly industrialized B2B transactional model, though the nuances of revenue recognition and pricing power vary significantly across its four divisions.

Automotive OEM (E-Mobility, Powertrain & Chassis)

- Model: Revenue is derived from long-term serial production contracts, typically spanning 5 to 7 years (the lifecycle of a vehicle platform). These contracts are "framework agreements" that specify price but not absolute volume, which is dependent on the commercial success of the OEM's vehicle.

- Pricing Mechanics: Pricing is established via a competitive bidding process (RFQ). A critical feature of this model is the "annual price-down" (productivity giveback), where Schaeffler is contractually obligated to reduce unit prices by roughly 1-3% annually, theoretically offset by manufacturing efficiencies. However, contracts increasingly include raw material surcharge mechanisms (alloy surcharges) that allow Schaeffler to pass through volatility in steel, copper, and aluminum prices to the OEM, albeit with a time lag.

- Revenue Recognition: Revenue is recognized at the point of transfer of control (delivery to the OEM's plant).

Vehicle Lifetime Solutions (Aftermarket)

- Model: This is a classic distribution model involving the sale of finished goods to wholesalers.

- Pricing Mechanics: Unlike the OEM business, Schaeffler possesses genuine pricing power here. The brand strength of LuK, INA, and FAG allows the company to pass on inflation costs to the market. Revenue is transaction-based but highly repetitive due to the recurring nature of vehicle wear and tear.

Bearings & Industrial Solutions

- Model: A hybrid of transactional sales (standard catalog bearings) and project-based revenue (wind turbines, aerospace).

- Recurring Elements: The company is aggressively scaling its "Optime" condition monitoring solutions, which introduce a recurring subscription revenue stream. Sensors installed on industrial machinery monitor vibration and temperature, and customers pay for the data analytics that predict failure. While currently a small portion of revenue, this is the highest-quality revenue stream in the portfolio.

Revenue Segmentation (9M 2025 Context)

Based on the Q3 2025 and 9M 2025 financial disclosures, the revenue profile reflects the merged entity's scale:

- Total Revenue: The group is running at a run-rate of approximately €23.5 - €25 billion annually.

- Segment Weighting:

- Powertrain & Chassis: Remains the largest volume contributor (~35-40%), though growth is flat to negative (-0.4% in Q3 2025).

- Bearings & Industrial Solutions: Approximately 25-30% of sales, currently suffering from cyclical headwinds (+2.2% FX-adjusted growth in Q3 2025).

- E-Mobility: The fastest growing segment (~20-25%), with 9M 2025 growth of +17.7%, reflecting the ramp-up of new projects.

- Vehicle Lifetime Solutions: Contributes ~15-20% of sales but a disproportionately high share of EBIT due to its superior margin profile.

3. Quality of Revenue

Predictability and Cycle Dependence

The quality of Schaeffler’s revenue stream is a study in contrasts, balancing the high predictability of the aftermarket with the cyclical volatility of the OEM and industrial sectors.

Automotive OEM (Medium-Low Predictability): While contracts are long-term, the predictability of volume is low. Revenue is directly correlated with global light vehicle production (LVP) rates. If consumer sentiment sours or interest rates rise, car purchases are deferred, and OEM "call-offs" for parts drop immediately. This was evident in the Q3 2025 results, where European weakness (-4.2% in Powertrain) weighed on the top line. Furthermore, the transition to EVs introduces "Platform Risk"—if Schaeffler wins a contract for a specific EV model that fails to sell (e.g., due to poor range or software issues), the anticipated revenue evaporates despite the contract win.

Vehicle Lifetime Solutions (High Predictability): This segment offers the highest quality revenue. It is counter-cyclical; in economic downturns, consumers delay new car purchases and repair existing vehicles, sustaining demand for Schaeffler’s products. The "Car Parc" (total number of registered vehicles) is the driver here, which grows steadily (~2.2% globally in 2025) regardless of new car sales cycles. The increasing average age of the car parc (11.5 years in 2025, up from 11.3) acts as a structural tailwind, enhancing the predictability of this cash flow.

Industrial (Cyclical Volatility):

Revenue here is tied to global industrial CAPEX cycles and PMI (Purchasing Managers' Index) data. Sectors like wind energy are lumpy and subject to regulatory subsidy regimes. However, the aerospace sub-segment provides a long-cycle, high-visibility revenue stream based on multi-year aircraft build rates.

Diversification Profiles

Geographic Diversification:

Schaeffler has achieved a relatively balanced global footprint, reducing dependence on any single economy.

- Europe (~40-45%): Still the dominant region, exposing the company to the continent's deindustrialization risks.

- Americas (~25%): A growth region, benefiting from re-shoring trends.

- Greater China (~20-25%): A critical growth engine but a source of high geopolitical risk.

- Asia/Pacific (~10%): Emerging markets like India providing faster growth (e.g., +5.3% in 9M 2025).

Customer Concentration:

Historically, Schaeffler had high exposure to the Volkswagen Group and Continental. The merger with Vitesco has diversified the customer base somewhat, but the top 5 customers likely still account for over 30% of revenue. This concentration grants the customers significant leverage in pricing negotiations, limiting Schaeffler’s ability to expand margins.

4. Cost Structure

Operational Leverage and Cost Components

Schaeffler operates a high-fixed-cost manufacturing model. This creates significant operating leverage: a small increase in volume leads to a large increase in profit, but a small decrease in volume crushes margins.

Manufacturing Costs (COGS):

- Materials: This is the largest variable cost component. Schaeffler is a massive consumer of steel (for bearings and shafts), aluminum (housings), copper (e-motors), and rare earth magnets. The volatility of these commodities is a constant risk, managed through hedging and surcharge clauses.

- Energy: As a metal-working company involving forging and heat treatment, energy costs are substantial. The structural increase in German energy prices post-2022 places Schaeffler’s German plants at a competitive disadvantage compared to Asian rivals, necessitating the "Program Forward" restructuring.

Personnel and Restructuring:

Labor costs are the second major component. With ~120,000 employees, wage inflation (particularly the IG Metall agreements in Germany) exerts upward pressure on the cost base.

- "Program Forward": Announced in November 2024, this program aims to structurally lower the break-even point in Europe. It involves cutting roughly 4,700 jobs (net 3,700 after relocations) and closing sites like Berndorf, Austria. The aim is to realize savings of €290 million annually by 2029, but this comes at a steep upfront cash cost of €580 million.

Research & Development (R&D):

R&D is a rigid fixed cost, running at approximately 6-7% of sales. To compete in E-Mobility, Schaeffler cannot cut R&D even if revenue dips. This intensity is necessary to develop next-generation SiC inverters and solid-state battery management systems but drags on current profitability compared to lower-tech industrial peers.

Margin Evolution

- Gross Margins: Hover around 18.5% (Q3 2025). The shift to E-Mobility is currently dilutive to gross margins because bought-in parts (like battery cells or magnets) make up a larger portion of the BOM (Bill of Materials) than in traditional machined steel parts, where Schaeffler added more value internally.

- EBIT Margins: The disparity between divisions is stark. While Vehicle Lifetime Solutions enjoys margins of ~15.1%, the E-Mobility division is in the ramp-up phase with thinner margins, and Powertrain & Chassis is managing a decline with margins around 11.1% (Q3 2024). The group target is >8%, but 9M 2025 performance was 4.2%, indicating the distance yet to travel.

5. Capital Intensity

Asset Base and Capex Cycle

Schaeffler is a capital-intensive business requiring heavy machinery, clean rooms for electronics assembly, and global logistics networks.

- CapEx Levels: The company is currently in a "CapEx Hump." The transition to E-Mobility requires building entirely new production lines for e-motors and power electronics, while the legacy ICE lines cannot simply be retooled. CapEx spending typically runs at 5-6% of sales (€1.2 - €1.4 billion annually).

- Asset Specificity: The assets are highly specific. A machine that grinds camshafts cannot be easily repurposed to wind copper coils for electric motors. This leads to the risk of "Stranded Assets"—machinery for ICE components that may not reach the end of its useful economic life before demand evaporates.

Working Capital and Cash Conversion

- Working Capital Requirements: The supply chain for mechatronics is more complex than for mechanics. Schaeffler must hold inventory of semiconductors and electronic components to buffer against shortages, tying up cash.

- Cash Conversion Efficiency: Cash conversion has historically been a challenge due to the high investment needs. However, Q3 2025 showed a notable improvement with Free Cash Flow (before M&A) of €175 million compared to a negative €364 million in the prior year. This suggests that the peak of the working capital build may have passed, and the company is beginning to optimize its inventory management post-merger.

6. Growth Drivers

1. Structural Growth: The Electrification Super-Cycle

The primary long-term growth lever is the increase in Content Per Vehicle (CPV) in electric vehicles.

- Mechanism: In an ICE vehicle, Schaeffler might supply €300 worth of bearings and engine parts. In an EV, by supplying a complete 3-in-1 E-Axle system including the inverter and motor, the CPV can rise to over €1,500.

- Status: The "E-Mobility Wave" is real, evidenced by double-digit revenue growth (+17.7% in 9M 2025) and strong order intake.1 This is a secular trend driven by regulation (EU 2035 ban on ICE).

2. Inorganic Growth: Vitesco Synergy Realization

The merger is a growth driver, not just a consolidation play.

- Cross-Selling: Schaeffler can now sell Vitesco’s specialized electronics to its deep roster of industrial customers (e.g., using automotive-grade sensors in wind turbines).

- Revenue Synergies: The combined entity can bid for larger "system" contracts that neither company could win alone.

3. Cyclical Recovery: Industrial Automation & Wind

While currently a drag, the industrial sector is poised for a cyclical rebound.

- Driver: A recovery in global PMI and the repowering of wind farms in Europe/US would provide immediate, high-margin volume growth for the Bearings division. The increasing size of wind turbines (requiring larger, higher-value bearings) acts as a structural multiplier on this cyclical recovery.

4. New Frontiers: Robotics and Aerospace

- Humanoid Robotics: The strategic partnership with Humanoid (announced Jan 2026) positions Schaeffler to capture the emerging market for robotic actuators. While negligible revenue today, this represents a massive TAM expansion for the 2030s.

- Aerospace: The post-pandemic recovery in air travel and defense spending is driving strong double-digit growth in the aerospace bearings segment.

7. Competitive Advantages

1. Manufacturing Excellence (The "Process" Moat)

Schaeffler’s foundational advantage is its mastery of high-precision manufacturing. The company produces billions of parts annually with defect rates measured in single-digit parts per million (PPM).

- Verifiability: This moat is verified by its dominance in the Aftermarket. Mechanics pay a premium for Schaeffler parts because they trust the "OE Quality." It is also visible in the high barriers to entry for safety-critical components like wheel bearings, where reliability is non-negotiable.

2. System Understanding (Post-Merger Capability)

Prior to the merger, Schaeffler was a mechanical expert. Vitesco was an electronics expert. The combination creates a rare "System Supplier."

- Mechanism: Schaeffler can now optimize the interplay between the mechanical gear tooth and the electronic control algorithm. For example, they can use software to damp mechanical vibrations, allowing for lighter, cheaper mechanical parts without sacrificing performance. This "holistic optimization" capability is a potent differentiator against pure-play component suppliers.

3. Customer Entrenchment and Switching Costs

In the automotive industry, "Design-In" creates high switching costs. Once Schaeffler’s E-Axle is designed into a vehicle platform (like the VW MEB or PPE), replacing it would require the OEM to re-engineer the chassis and re-validate the entire powertrain—a process costing millions and taking years. This grants Schaeffler a "lock-in" for the 5-7 year life of the platform.

8. Industry Structure and Position

Value Chain Analysis

Schaeffler sits in the middle of a pressured value chain.

- Upstream: Powerful raw material suppliers (steel, copper) and semiconductor foundries (TSMC, etc.).

- Downstream: Highly consolidated OEM customers (VW, Stellantis) with immense purchasing power.

- Implication: Profit pools in this industry are structurally squeezed. Suppliers like Schaeffler must rely on scale and technology differentiation to resist commoditization.

Market Structure: The Era of the "Mega-Supplier"

The Tier 1 supplier industry is consolidating into a barbell structure: massive "Mega-Suppliers" capable of delivering full systems, and small niche specialists.

- Consolidation: The Vitesco merger propels Schaeffler into the top tier globally, competing directly with Bosch, ZF Friedrichshafen, Denso, and Magna.

- Bearings Oligopoly: In the industrial bearings market, Schaeffler operates in a stable oligopoly alongside SKF (Sweden) and Timken (USA). This market structure allows for rational pricing behavior and higher margins compared to the cutthroat automotive sector.

Positioning: Price Taker vs. Price Setter

- Automotive OEM: Schaeffler is largely a Price Taker. The annual "productivity givebacks" are standard.

- Aftermarket & Specialized Industrial: Schaeffler acts as a Price Setter. In the aerospace bearing niche or the branded aftermarket, they can dictate terms due to the scarcity of validated alternatives.

9. Unit Economics and KPIs

Key Performance Indicators

- Book-to-Bill Ratio: This is the vital sign for the E-Mobility growth story. A ratio >1.0x indicates that the order backlog is growing. Schaeffler reported a very strong Book-to-Bill of 2.0x for Automotive Technologies in Q3 2024, signaling robust future revenue coverage.

- E-Mobility Lifetime Order Intake: A metric of ~€3.0 billion in Q1 2025 translates to future revenue streams. The "quality" of these orders (margin profile) is the key unknown variable.

- Unit Profitability (EBIT Margin):

- Aftermarket: ~15-16% (Stable, high quality).

- Powertrain (ICE): ~11-12% (Harvesting mode).

- E-Mobility: Currently low single digits or negative due to ramp-up costs. The path to the group target of 8% relies entirely on this segment scaling to ~5-8% margins by 2028.

Trend Analysis

The unit economics are currently stabilizing. The aftermarket remains a fortress of profitability. The E-Mobility segment is moving from "investment mode" (cash burn) to "ramp-up mode" (operating leverage), evidenced by the gross margin improvement of +3.0 percentage points in the division in Q3 2025.

10. Capital Allocation and Balance Sheet

Historical Allocation and M&A

Schaeffler has historically been aggressive in M&A (e.g., the Continental takeover attempt in 2008, which defined its debt profile for a decade). The 2024 acquisition of Vitesco was another bold, transformative move.

- Dividends: The policy is to pay out 30-50% of net income. Even amidst the merger, Schaeffler paid a dividend of €0.25 per share in 2025, signaling confidence to income investors, though this was a reduction from previous years (€0.45).

Balance Sheet Strength (The Weak Link)

The balance sheet is currently the company’s Achilles' heel.

- Leverage: Following the Vitesco transaction, Net Financial Debt / EBITDA remains elevated, estimated at >2.5x. This is above the company’s own mid-term target of 1.2x - 1.7x.

- Debt Maturity Profile: The company faces significant maturities. Approximately €750 million to €1 billion in bonds and loans are due in 2025.

- Liquidity Management: Schaeffler proactively addressed this by issuing €1.15 billion in bonds in March 2025 (tranches due 2028 and 2031). While this mitigates immediate liquidity risk, it locks in interest expenses at higher rates (4.25% - 5.375%), creating a higher hurdle for value creation.

- Credit Rating: S&P affirmed the 'BB+' rating but revised the outlook to Negative in early 2025. This "junk" rating restricts access to certain pools of capital and increases borrowing costs.

Value Creation Assessment

Capital allocation has likely destroyed value in the short term due to the high premium paid for Vitesco and the subsequent integration costs. However, from a strategic perspective, the allocation was existential—without Vitesco, Schaeffler faced slow obsolescence. The value creation verdict depends entirely on the realization of the €600m synergies by 2029.

11. Risks and Sources of Error

1. Integration Execution Risk (High)

Merging two large German engineering cultures is notoriously difficult.

- Failure Scenario: If the integration of IT systems is delayed, or if key Vitesco software talent leaves due to cultural clashes with Schaeffler’s mechanical hierarchy, the "System Supplier" thesis fails. The €600m synergy target could prove illusory, leaving the company with the debt but not the cash flow to service it.

2. Geopolitical & Trade Risk (Critical)

With ~20-25% of revenue from Greater China, Schaeffler is exposed to the "Decoupling" narrative.

- Scenario: If the EU imposes punitive tariffs on Chinese EVs (as discussed in 2025), and China retaliates against German suppliers, Schaeffler’s growth engine would seize. The "Local-for-Local" strategy mitigates this but cannot eliminate the risk of profit repatriation blocks or sanctions.

3. The "Valley of Death" Cash Flow Risk

- Mechanism: Schaeffler relies on profits from ICE components (Powertrain division) to fund the losses in E-Mobility. If ICE volumes collapse faster than expected (e.g., accelerated bans or consumer shifts), the "Cash Cow" dries up before the "Growth Star" becomes profitable. This would create a liquidity crunch, potentially forcing a capital raise or dividend suspension.

4. Technological Obsolescence

- Risk: The move to "Hub Motors" or other exotic powertrain architectures could bypass Schaeffler’s E-Axle centralization thesis. Similarly, if OEMs decide to insource E-Axles entirely (as Tesla does), the addressable market for Tier 1s shrinks to low-margin components.

12. Valuation and Expected Return Profile

Comparative Valuation

As of January 2026, Schaeffler trades at a valuation that reflects deep skepticism.

- P/E Ratio: Trading at a low-to-mid single-digit P/E based on 2026 adjusted earnings estimates. This is a discount to peers like SKF (typically ~10-12x) and pure-play industrial tech companies.

- EV/EBIT: Trading at roughly 6x-7x forward EBIT. This multiple implies the market views Schaeffler as a "melting ice cube" of ICE assets rather than a growth tech company.

- Dividend Yield: Approximately 2.5% - 3.0%, providing some support, though the payout ratio is stretched.

Scenario Framework

| Scenario | Assumptions | Implied Valuation Impact |

|---|---|---|

| Bear Case | Integration stalls; synergies <€200m realized. Global trade war with China escalates. Industrial recession deepens. Leverage stays >2.5x. | Downside (20-30%): Share price drifts lower toward distressed industrial multiples (<€4.50). Credit rating downgrade to BB flat. |

| Base Case | Synergies of ~€300m realized by 2027. E-Mobility reaches breakeven EBIT. Industrial markets stabilize. Leverage reduces slowly to ~2.0x. | Fair Value / Modest Upside (15%): Price stabilizes around €6.00-€7.00. Market begins to credit the "Motion Tech" narrative. |

| Bull Case | Full €600m synergies visible. Industrial V-shaped recovery. E-Mobility hits >5% margins. China growth continues. | Significant Upside (>50%): Re-rating to >€10.00 as the market applies a "Technology" multiple rather than an "Auto Parts" multiple. |

13. Catalysts and Time Horizon

Short-Term Catalysts (0-12 Months)

- Quarterly Synergy Reporting: The market needs to see the first concrete "proof points" of the Vitesco synergies in the Q1/Q2 2026 reports. Cost-out measures from "Program Forward" hitting the P&L will be closely watched.

- Index Inclusion: The unification of share classes (100% voting rights) and increased free float (~21%) could trigger inclusion in major indices like the MDAX or MSCI Europe, driving passive inflows.

- Refinancing News: Successful retirement of the 2025 bond maturities without straining liquidity will remove a key overhang.

Medium-Term Catalysts (12-36 Months)

- E-Mobility Breakeven: The specific quarter where the E-Mobility division reports a solid positive EBIT margin (e.g., >4%) will be the psychological turning point for the stock, proving the "J-curve" investment phase is over.

- Deleveraging Milestone: Reaching a leverage ratio of <2.0x will likely trigger a rating outlook upgrade back to "Stable," lowering the cost of equity.

The thesis is based on a complicated industrial integration and a cycle turn, which don't happen in just one quarter. The market probably won't see the value until 2027 or 2028, when the "clean" earnings power of the combined company becomes clear after taking out one-time costs for integration and restructuring.

References

- Interim Statement 9M 2025 - the Schaeffler Group, Accessed January 22, 2026, https://www.schaeffler.com/remotemedien/media/_shared_media_rwd/08_investor_relations/reports/2025_q3_schaeffler_interim_statement_en_c2nbo5.pdf

- Schaeffler delivers robust third quarter | Press Releases, Accessed January 22, 2026, https://www.schaeffler.com/en/media/press-releases/press-releases-detail.jsp?id=88136385

- Analysts & Consensus - the Schaeffler Group, Accessed January 22, 2026, https://www.schaeffler.com/en/investor-relations/share/analysts-consensus/

- TRANSCRIPT / Q3 2025 Schaeffler Group EARNINGS, Accessed January 22, 2026, https://www.schaeffler.com/remotemedien/media/_shared_media_rwd/08_investor_relations/presentations/2025_q3_schaeffler_conference_call_transcript.pdf

- Schaeffler provides more information on structural measures for locations outside of Germany | Press Releases, Accessed January 22, 2026, https://www.schaeffler.com/en/media/press-releases/press-releases-detail.jsp?id=88061888

- Schaeffler announces structural measures in Europe to boost competitiveness | Press Releases, Accessed January 22, 2026, https://www.schaeffler.com/en/media/press-releases/press-releases-detail.jsp?id=88057859

- Schaeffler Financial Figures Q3 2025, Accessed January 22, 2026, https://www.schaeffler.com/remotemedien/media/_shared_media_rwd/08_investor_relations/reports/2025_q3_schaeffler_financial_figures_5fg8zq.pdf

- Investor Relations - the Schaeffler Group, Accessed January 22, 2026, https://www.schaeffler.com/en/investor-relations/

- Q3 2025 Schaeffler Group earnings, Accessed January 22, 2026, https://www.schaeffler.com/remotemedien/media/_shared_media_rwd/08_investor_relations/presentations/2025_q3_schaeffler_conference_call_presentation_18wswp.pdf

- SKF Q3 2025: Improved margin in challenging market conditions, Accessed January 22, 2026, https://www.skf.com/group/news-and-events/news/2025/2025-Oct-29-skf-q3-2025-improved-margin-in-challenging-market-conditions

- Q3 and 9M 2024 Schaeffler Group earnings, Accessed January 22, 2026, https://www.schaeffler.com/remotemedien/media/_shared_media_rwd/08_investor_relations/presentations/2024_q3_schaeffler_conference_call_presentation_hji1z3.pdf

- Schaeffler off to good start in 2025 | Press Releases, Accessed January 22, 2026, https://www.schaeffler.com/en/media/press-releases/press-releases-detail.jsp?id=88098883

- Schaeffler kicks off Roadmap 2025 | Press Releases, Accessed January 22, 2026, https://www.schaeffler.de/en/news_media/press_releases/press_releases_detail.jsp?id=87602880

- Global Auto Supplier Schaeffler Group's Outlook To N | S&P Global Ratings, Accessed January 22, 2026, https://www.spglobal.com/ratings/pt/regulatory/article/-/view/type/HTML/id/3320082

- Schaeffler (OTCPK:SCAF.F) - Stock Analysis - Simply Wall St, Accessed January 22, 2026, https://simplywall.st/stocks/us/automobiles/otc-scaf.f/schaeffler

- Merger of Vitesco Technologies Group AG into Schaeffler Group successfully completed, Accessed January 22, 2026, https://www.schaeffler.com/en/media/press-releases/press-releases-detail.jsp?id=88049282

- Schaeffler Group, Accessed January 22, 2026, https://www.schaeffler.com/remotemedien/media/_shared_media_rwd/08_investor_relations/presentations/20240104_schaeffler_presentation_proxy_advisors.pdf