Tencent Music Entertainment Group

TME is a strong, money-making leader that is moving towards becoming a reliable source of ongoing income, but its current price reflects extra risk that doesn't fully recognize its ability to make profits and return capital.

The Great Pivot to Recurring Quality

Summary

Tencent Music Entertainment Group (TME) functions as the definitive infrastructure of the Chinese music economy, operating an integrated ecosystem that spans streaming, social entertainment, karaoke, and live performance. The company has successfully executed a fundamental strategic pivot—transitioning from a business model historically dependent on volatile, regulatory-sensitive social entertainment revenue (virtual tipping) to one driven by high-quality, recurring subscription cash flows. As of the third quarter of 2025, this transition is evidenced by a 27.2% year-over-year growth in online music services revenue, which now constitutes the decisive majority of the top line. Economically, TME is characterized by strong operating leverage, a negative working capital cycle that funds growth, and a fortress balance sheet holding over RMB 36 billion in liquidity. Its primary competitive advantage lies in its "dual engine" integration with the Tencent social ecosystem (WeChat/QQ), creating a user acquisition funnel that competitors find nearly impossible to replicate. However, significant risks persist in the form of fierce competition for user time from short-video platforms like Douyin and the ever-present shadow of regulatory intervention in the digital economy.

1. What They Sell and Who Buys It

Tencent Music Entertainment Group does not merely sell access to music; it sells a comprehensive digital lifestyle centered around audio interaction. Unlike Western counterparts such as Spotify, which focus almost exclusively on a lean-back listening experience, TME operates a portfolio of distinct applications that cater to active participation, social interaction, and fandom identity. The company’s product suite is segmented to capture different demographics and psychographics within the Chinese market, effectively creating an internal monopoly where users may switch apps but remain within the TME ecosystem.

Core Product Matrix and Value Proposition

The company’s offering is anchored by four flagship applications, each addressing specific user needs and motivations.

QQ Music stands as the premium flagship platform, tailored for the "Trendsetter" demographic. This user base primarily consists of Gen Z and Millennial consumers residing in Tier 1 and Tier 2 cities, heavily influenced by pop culture and fandom dynamics. For these users, the motivation to engage extends beyond utility; they buy into an identity. QQ Music integrates deep social features that allow users to display their fandom—purchasing digital albums to boost chart rankings, acquiring exclusive "Super VIP" (SVIP) badges, and participating in artist-specific community "Guilds." The product solves the problem of "cultural FOMO" (fear of missing out) by serving as the primary launchpad for major releases from Mandopop stars like Jay Chou and international K-Pop acts.

Kugou Music addresses the mass market, particularly serving users in lower-tier cities and older demographics. Its value proposition is built on functional utility and localization. Kugou differentiates itself with powerful audio enhancement software, such as "Viper Audio," which digitally optimizes sound output for lower-end hardware. This feature is a critical selling point for its target audience, solving the problem of poor hardware quality by delivering a premium listening experience through software. Additionally, Kugou hosts a vibrant ecosystem of internet folk songs and cover versions, catering to local tastes that are often underserved by the polished, mainstream focus of QQ Music.

Kuwo Music targets the "functional listener," specifically focusing on in-car audio and niche audiophile segments. As the Chinese electric vehicle (EV) market explodes, Kuwo has positioned itself as the default operating system for in-cabin entertainment, partnering with major OEMs to offer seamless integration. The user here is often a commuter or a professional who requires curated, uninterrupted DJ mixes or high-fidelity playback during travel. The motivation is utility and seamlessness—Kuwo solves the fragmentation problem of connecting mobile devices to car systems by offering a native, high-quality in-dash experience.

WeSing (Quanmin K Ge) represents the social entertainment arm, targeting the "social performer." This karaoke application serves a broad demographic ranging from teenagers to retirees, effectively digitizing the traditional Asian karaoke parlor experience. Users do not "buy" music here; they buy social validation. The platform allows users to record singing performances, share them with a social graph, and receive virtual gifts. The core problem solved is social isolation and the human desire for creative expression and recognition. Although the revenue contribution from this segment has declined due to regulatory shifts, it remains a vital engagement tool that feeds the broader ecosystem.

Customer Segmentation Analysis

The TME customer base is massive, with 551 million monthly active users (MAUs) for online music services as of Q3 2025. However, the "buyer" is a specific subset of this vast pool. The company effectively segments its users into three economic tiers:

- The Free User: This segment monetizes through their attention (advertising) and data, which feeds the recommendation algorithms.

- The Subscriber (125.7 million): This user pays a monthly recurring fee for ad-free listening and high-quality audio. Their motivation is convenience and quality. This segment grew 5.6% year-over-year in Q3 2025, demonstrating the increasing willingness of the Chinese consumer to pay for content.

- The Super Fan / SVIP: This is the highest-value cohort. They pay significantly higher monthly fees (often 3-4x the standard rate) for the "Super VIP" status, which unlocks Dolby Atmos streaming, digital collectibles, and advanced hardware support. Their motivation is status and optimization. This segment is the primary driver of the 10.2% increase in Average Revenue Per Paying User (ARPPU) observed in 2025.

2. How They Make Money

TME employs a sophisticated hybrid revenue model that is currently undergoing a structural inversion. Historically, the company relied on a "tipping" model derived from social entertainment. In the current fiscal period of 2025-2026, the model has decisively shifted toward a "subscription-centric" recurring revenue engine, supplemented by high-margin advertising and artist services.

Revenue Models and Pricing Mechanics

Online Music Services (Recurring & Transactional): This segment has become the primary growth engine, generating RMB 6.97 billion in Q3 2025, a 27.2% increase year-over-year.

- Subscriptions: TME utilizes a tiered subscription model. The standard "Green Diamond" membership offers basic ad-free privileges. The "Super VIP" (SVIP) tier functions as an upsell mechanism, bundling premium sound technologies (like neural audio enhancement) and digital privileges. The pricing strategy is psychological; by offering a "good" basic tier and a "best" SVIP tier, TME effectively discriminates price based on willingness to pay, capturing surplus value from audiophiles and superfans without alienating the mass market.

- Advertising: Monetization of the free user base occurs through display ads, audio ads, and innovative "rewarded video" formats where users watch advertisements to unlock temporary premium features. This revenue is transaction-based and correlates with user time spent and broader macroeconomic advertising demand.

- Digital Sales: TME acts as a marketplace for digital albums and singles. While bulk-buying (buying thousands of copies of the same album) has been regulated, fans still purchase digital collectibles and limited editions to support artists, providing a high-margin transactional revenue stream.

Social Entertainment Services (Transaction-Based): This segment generated RMB 1.49 billion in Q3 2025, representing a decline of 2.7% year-over-year.

- Virtual Gifting: The primary monetization mechanic here is the sale of virtual currency (e.g., K-coins). Users purchase these coins to bestow virtual gifts (flowers, sports cars, rockets) on streamers or karaoke performers. TME takes a platform commission on these transactions, sharing the remainder with the content creator and their agency. This revenue is highly impulsive and technically "one-time," though habit formation among "whales" (high spenders) can create pseudo-recurring behavior.

- Value-Added Memberships: Within WeSing, users can subscribe for premium recording tools and filters, adding a small recurring component to this segment.

Revenue Mix Shift

The most critical narrative in TME’s 2025 financials is the dominance of the Online Music segment. In previous years (circa 2019-2021), Social Entertainment accounted for the majority of revenue. As of Q3 2025, Online Music Services constitute approximately 82% of total revenue. This shift signifies a move from a "high-volatility, regulatory-risk" model to a "stable, recurring utility" model. The subscription revenue alone reached RMB 4.50 billion, growing 17.2% year-over-year.

3. Quality of Revenue

The transformation of TME’s revenue mix has fundamentally altered the quality profile of its cash flows, resulting in a business that is more predictable, resilient, and valuable to public market investors.

Predictability and Recurring Nature

The surge in subscription revenue to over half of the total revenue base introduces a high degree of predictability. Music streaming subscriptions are characterized by notoriously low churn rates relative to video streaming; users invest time in building personal libraries and playlists, creating high switching costs. Consequently, the RMB 4.50 billion in quarterly subscription revenue can be modeled with a high degree of confidence into future periods. The volatility associated with the social entertainment segment—where revenue could fluctuate wildly based on the activity of a few wealthy "whale" users or regulatory interventions—is now a minority factor, dampening the overall variance of the company's financial performance.

Diversification and Concentration

TME has achieved a healthy level of diversification across its monetization engines. It is no longer reliant on a handful of top live streamers to drive profitability. Instead, revenue is granularly distributed across 125.7 million paying subscribers. This massive fragmentation of the payer base essentially eliminates customer concentration risk. While the company is operationally concentrated in the Chinese domestic market, its revenue sources are split between recurring subscriptions (consumer utility), advertising (corporate marketing budgets), and merchandise (consumer discretionary), providing a hedge against sector-specific downturns.

Economic Sensitivity

The shift to subscriptions enhances TME's defensive characteristics. A monthly music subscription, priced at roughly the cost of a single meal (RMB 12-15), is a low-ticket item that consumers are unlikely to cut during economic headwinds. It provides high utility for low cost. Conversely, the legacy social entertainment business, driven by large impulse purchases of virtual gifts, was highly sensitive to consumer sentiment and economic confidence. By minimizing exposure to the latter, TME has insulated itself from the worst effects of macroeconomic volatility in China. The advertising component remains cyclical, but the scarcity of premium audio inventory provides some pricing power even in softer markets.

4. Cost Structure

TME operates a platform business model characterized by high initial fixed costs for technology and varying variable costs associated with content licensing. The evolution of its cost structure tells the story of an industry maturing from a "land grab" phase to a "rationalized profit" phase.

Key Cost Factors

Content Royalties (Cost of Revenue): This is the single largest expense line item. It encompasses the fees paid to music labels (Universal, Sony, Warner, and domestic aggregators) for the rights to stream their catalogs. Historically, platforms paid exorbitant "minimum guarantees" to secure exclusive rights. Following the regulatory ban on exclusive licensing in 2021, these costs have rationalized. TME now pays largely based on usage or non-exclusive market rates, significantly improving its operating leverage. The 18.8% increase in cost of revenues in Q3 2025 was primarily driven by revenue-generating activities like offline performances and merchandise, rather than inflated licensing fees.

Revenue Sharing Fees: This cost is specific to the Social Entertainment segment. It represents the payout to live streamers and their agencies. As Social Entertainment revenue declines, this cost line naturally contracts, acting as a self-correcting mechanism for margins.

Selling and Marketing Expenses: TME demonstrates remarkable efficiency here. In Q3 2025, selling and marketing expenses were RMB 260 million, representing a mere ~3% of total revenues. This exceptionally low ratio highlights the organic traffic power of the Tencent ecosystem; TME does not need to spend heavily on performance marketing to acquire users, as they are funneled naturally from WeChat and QQ.

Margin Evolution and Scalability

The structural improvements in costs are visible in the gross margin expansion. Gross margin reached 43.5% in Q3 2025, up from 42.6% in the prior year. This level is significantly higher than global peers like Spotify, which typically hovers around 25-30%. The disparity is driven by TME’s vertically integrated model and its ability to monetize content through higher-margin channels like social interaction and digital merchandise. As the subscription base grows, the fixed nature of certain content costs and platform infrastructure allows for continued operating margin expansion, which reached approximately 31.9% in Q3 2025.

5. Capital Intensity

TME operates an "asset-light" digital business model. It requires minimal investment in tangible physical assets, resulting in a highly favorable capital efficiency profile.

Asset Requirements and CapEx Cycle

The primary assets required for operation are servers, data centers (often leased or utilized via Tencent Cloud), and office space. Consequently, capital expenditure (CapEx) for property, plant, and equipment is a negligible fraction of revenue. The company is in a mature phase of its capital cycle, requiring only maintenance CapEx to support traffic growth and AI computational needs.

Working Capital Dynamics

A key strength of TME’s financials is its negative working capital cycle. The company collects subscription fees from users upfront (at the beginning of the month or year) but pays royalties to record labels and content partners in arrears (typically quarterly or semi-annually). This structure creates a permanent "float" of cash that funds operations and interest income. As the company grows, this float grows, effectively providing interest-free financing for the business.

Cash Conversion Efficiency

TME’s conversion of net income to free cash flow (FCF) is highly efficient. The primary non-cash expense is the amortization of content rights and intangible assets. Since the cash outflow for these rights is often spread out or negotiated as advances, the operating cash flow remains robust. As of September 30, 2025, the company held a massive liquidity position of RMB 36.08 billion (US$5.07 billion) in cash and term deposits, underscoring its ability to generate cash far in excess of its reinvestment needs.

6. Growth Drivers

TME’s growth narrative has shifted from "user acquisition" to "user monetization." With the Chinese internet population reaching saturation, the levers for growth are now qualitative rather than quantitative.

Structural Drivers (Long-Term)

ARPPU Expansion via Tiering: The most potent lever is increasing the Average Revenue Per Paying User. TME is successfully migrating users from basic subscriptions to the "Super VIP" (SVIP) tier. By bundling high-value features like Dolby Atmos, digital vinyl, and exclusive hardware optimizations (e.g., partnerships with speaker manufacturers), TME justifies price points that are 2-3x the base rate. The 10.2% YoY growth in ARPPU in Q3 2025 validates this strategy.

IoT and In-Car Audio Penetration: The proliferation of connected devices offers a new frontier for subscriber acquisition. TME is embedding its services directly into the operating systems of smart speakers, televisions, and, most importantly, electric vehicles. By becoming the native audio player in cars from BYD, Tesla China, and XPeng, TME secures a captive audience in a high-fidelity listening environment, which naturally drives demand for high-quality (SVIP) subscriptions.

Long-Form Audio and Podcasting: Diversifying beyond music, TME is expanding its content library to include audiobooks, podcasts, and radio dramas. This content has a different cost structure (often fixed-fee or UGC) compared to music royalties and increases user time spent on the platform, creating new inventory for audio advertising.

Cyclical Drivers (Short-to-Medium Term)

Live Events and Offline Performance: The "TME Live" brand bridges the online and offline worlds. As the post-pandemic concert economy booms, TME acts as a promoter, ticketer, and digital broadcaster. It monetizes the same event multiple times: selling physical tickets, selling digital livestream access, and selling virtual merchandise during the stream. This segment showed triple-digit growth in Q3 2025, though it remains subject to the seasonality of touring cycles.

7. Competitive Advantages

TME possesses a "wide moat" protecting its economic castle, built primarily on network effects and high switching costs.

The Tencent Ecosystem Integration

The single most durable advantage is TME’s lineage as a subsidiary of Tencent Holdings. The integration with WeChat (Weixin) and QQ provides a distribution advantage that is structurally impossible for competitors to match. TME users can share music seamlessly to their WeChat Moments or status, creating a viral loop of discovery and re-engagement. Furthermore, the use of WeChat Pay and QQ accounts for login eliminates friction in the onboarding and payment process, lowering the Customer Acquisition Cost (CAC) to industry-leading lows.

Data Moat and Switching Costs

With over a decade of data from hundreds of millions of users, TME’s recommendation algorithms ("Muse") are highly tuned to Chinese cultural nuances. For a user, the "switching cost" is not financial but data-centric. A user who has curated playlists, favorites, and listening history on QQ Music over five years faces a significant barrier to leaving, as they would lose their "digital identity" and the algorithmic personalization that knows their taste better than they do themselves. This stickiness is verifiable in the company's retention rates and the stability of its paying user base despite competitive incursions.

Economies of Scale in Content

While exclusive rights are gone, scale still matters. TME’s massive revenue base allows it to outspend competitors on "long-tail" content rights, indie artist support programs ("Tencent Musicians"), and exclusive windowing strategies. It can afford to license niche genres and back-catalogs that smaller players cannot justify, reinforcing its position as the "comprehensive" library for the Chinese consumer.

8. Industry Structure and Position

The Chinese Audio Oligopoly

The Chinese online music market is a consolidated oligopoly, structurally more favorable to incumbents than the fragmented Western markets.

The dominant leader: TME is the undisputed hegemon, controlling an estimated 60–70% of the music streaming market. It acts as the price setter for the industry. Its moves to raise subscription prices or introduce new tiers set the standard that competitors follow.

The Challenger: NetEase Cloud Music (Cloud Village) holds the number two position. NetEase differentiates through a strong community vibe and a focus on "indie" culture, appealing to a younger, more urban demographic. While it is a formidable rival in terms of cultural cachet, it lacks TME’s scale and profitability.

The Asymmetric Threat: ByteDance (Douyin/TikTok) represents a cross-category threat. Its standalone music app, "Soda Music" (Qishui Yinyue), leverages the massive traffic of Douyin to acquire users efficiently. However, Soda Music serves a different use case—"lean-back" discovery based on viral 15-second clips—compared to TME’s "lean-forward" library consumption. While Douyin competes for time, it has yet to prove it can compete effectively for subscriptions at the same scale.

Value Chain Dynamics

In the post-exclusivity era, the balance of power has shifted slightly from rights holders (labels) back to platforms (distributors). With no single platform able to lock up content exclusively, labels must distribute everywhere to maximize revenue. This reduces the leverage of any single label to demand exorbitant minimum guarantees. TME, as the largest check-writer in the region, retains significant bargaining power.

9. Unit Economics and Key Performance Indicators

The unit economics of TME depict a business that is increasing its efficiency and extraction of value per user.

User Metrics (Q3 2025):

- Online Music Paying Users: 125.7 million (+5.6% YoY).

- Paying Ratio: 22.8%. This metric is crucial. It has grown steadily from single digits, indicating a structural shift in consumer behavior. While still lower than Spotify’s global ratio (~40%), the gap represents the remaining "runway" for growth.

- Churn: While not explicitly reported, the stability of the paying user base implies low churn. The 4.3% decline in total MAUs suggests that TME is shedding low-value, casual "tourist" users (likely to short-video apps) while retaining the high-value core that generates revenue.

Monetization Metrics:

- Monthly ARPPU: RMB 11.9 (+10.2% YoY). The double-digit growth in ARPPU outpacing user growth confirms that the "value-up" strategy (SVIP) is working.

- LTV/CAC: The Lifetime Value (LTV) of a subscriber is expanding due to higher ARPPU and sticky retention. Meanwhile, Customer Acquisition Cost (CAC) remains structurally suppressed by the Tencent ecosystem funnel. This widening spread between LTV and CAC drives the robust operating margins.

10. Capital Allocation and Balance Sheet

TME’s approach to capital allocation has matured from aggressive empire-building to a shareholder-friendly return model, signaling confidence in its long-term cash generation.

Balance Sheet Strength

The company maintains a fortress balance sheet. As of September 30, 2025, TME held RMB 36.08 billion in cash and short-term investments. It carries negligible debt, resulting in a massive net cash position. This liquidity buffer insulates the company from capital market volatility and provides ample dry powder for strategic moves.

Capital Return Program

Beginning in 2024 and accelerating into 2025, TME has prioritized returning capital to shareholders:

- Dividends: The company initiated an annual dividend policy. For the fiscal year 2024, it declared a total cash dividend of approximately US$273 million. This establishes a floor for the stock and attracts income-oriented investors.

- Share Repurchases: In March 2025, the Board approved a new share repurchase program of up to US$1 billion over 24 months. Given the company’s strong free cash flow, these buybacks are accretive to earnings per share and signal management’s view that the stock is undervalued.

Value Creation

Historical capital allocation in content (licensing) and technology (AI/audio) has created the moat the company enjoys today. The pivot to returning cash suggests that large-scale M&A is less of a priority, or that the company can fund both organic growth and shareholder returns simultaneously - a hallmark of a high-quality compounder.

11. Risks and Sources of Error

Despite its dominance, TME faces specific, high-impact risks that could derail the equity story.

Competition for Attention (The "Douyin" Risk): The primary existential threat is not another music app but the "attention economy." Short-video platforms like Douyin capture an immense share of user screen time. If music becomes purely background noise for video consumption, the perceived value of a standalone music subscription could erode. "Soda Music" attempts to bridge this by converting video views into streams, directly attacking TME's user acquisition funnel.

Regulatory Intervention:

The Chinese digital economy operates under the constant shadow of regulation. While the "anti-monopoly" phase has stabilized, risks remain regarding the "fan economy." Future regulations could cap the price of digital albums, restrict the sale of virtual items (tipping) further, or mandate even lower algorithmic influence. Any regulatory cap on subscription pricing or mandatory "free tiers" would severely impact the valuation.

Macroeconomic Sensitivity:

While subscriptions are resilient, TME’s growth relies on upselling users to higher tiers (SVIP) and selling concert tickets/merchandise. These are discretionary expenditures. A prolonged economic slowdown or high youth unemployment in China could compress ARPPU growth as users downgrade to cheaper tiers or free ad-supported versions.

Technological Disruption (AI Music):

Generative AI poses a long-term uncertainty. If AI-generated music floods the market and becomes "good enough" for casual listening, it could commoditize the back-catalog. However, TME is actively investing in AI tools, attempting to co-opt this technology to lower content costs rather than be displaced by it.

12. Valuation and Expected Return Profile

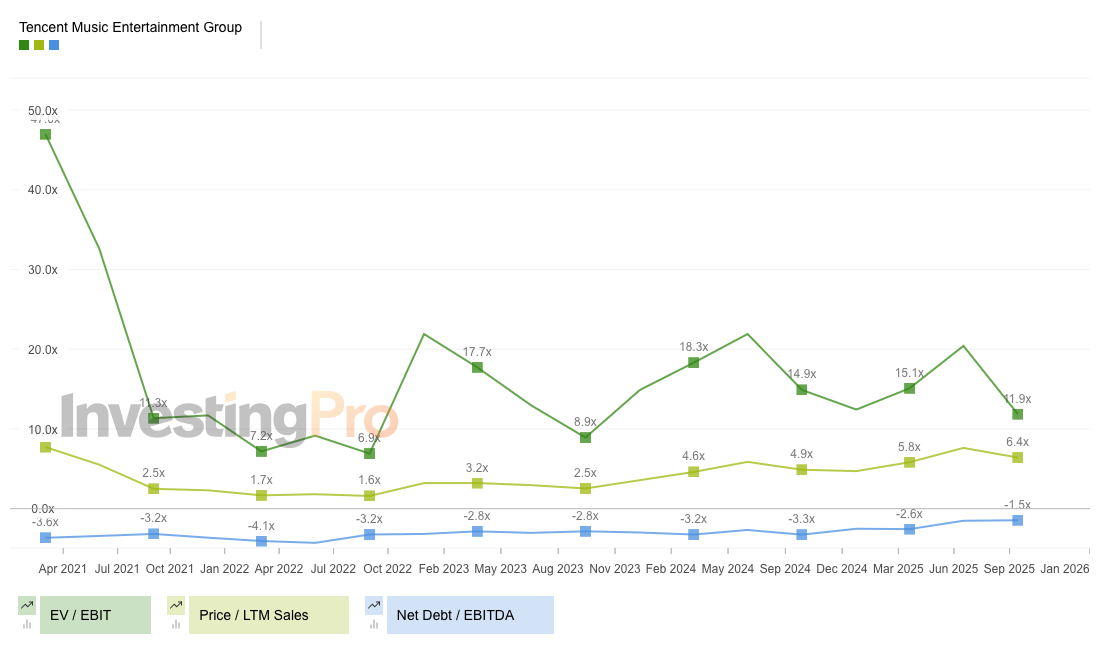

Valuation Context

As of January 30, 2026, TME trades at a market capitalization of approximately US$28.83 billion.

- P/E Ratio: The stock trades at roughly 18x - 20x projected 2026 earnings (based on annualized Q3 2025 profitability trends).

- Comparison: This represents a significant discount to global peer Spotify (often trading >30x Forward P/E), despite TME having superior gross margins (43.5% vs Spotify’s ~30%) and a stronger balance sheet. This discount reflects the "China Risk" premium and the historically lower growth rate of the top line.

Scenario Framework

Base Case (Fair Value $22 - $25):

- Assumptions: Subscription revenue grows at ~15% CAGR; ARPPU continues modest expansion via SVIP; Social Entertainment stabilizes. Margins hold steady.

- Outcome: The stock re-rates to ~22x earnings as the market accepts the stability of the new business model. Returns are driven by earnings growth (15-20%) plus dividends and buybacks.

Bull Case (Target $30+):

- Assumptions: SVIP adoption accelerates; TME dominates the in-car OS market; Macro economy rebounds, driving ad and merchandise sales.

- Outcome: Multiple expansion to 25x-28x. TME is viewed as a "must-own" consumer staple in China.

Bear Case (Downside to ~$12):

- Assumptions: Competition from Soda Music causes churn in paying users; Regulatory intervention hits merchandise/tipping hard again. Margins compress due to a price war.

- Outcome: Multiple compression to 12x-15x. The stock trades purely on cash support.

Attractiveness

At current levels (~$17/share), the price appears attractive. The market is pricing TME as a low-growth utility, ignoring the embedded operating leverage and the "option value" of its massive cash pile. For the price to be considered "expensive," TME would need to trade closer to $28-$30/share without a corresponding acceleration in growth.

13. Catalysts and Time Horizon

Short-Term Catalysts (3-6 Months)

- Earnings Confirmation: The Q4 2025 earnings report (expected March 2026) will be critical to confirm that the Social Entertainment drag has truly bottomed out and to update on the pace of the $1 billion buyback execution.

- Capital Return Execution: Any aggressive deployment of the buyback authorization during market dips provides a structural bid for the stock, reducing volatility.

Medium-Term Catalysts (6-18 Months)

- SVIP Milestones: Reporting specific milestones for the Super VIP tier (e.g., crossing 20 million SVIP users) would act as a powerful proof point for the ARPPU expansion thesis, forcing analysts to upgrade revenue models.

- In-Car Partnership Announcements: Definitive agreements with global EV brands for exclusive Chinese market integration would solidify the "IoT" growth narrative.

Long-Term Drivers (2+ Years)

- AI Profitability: The successful rollout of AI-generated content tools that reduce the cost of goods sold (content costs) for functional music (sleep, focus, workout playlists) could structurally lift gross margins toward 50%.

Time Horizon

The thesis requires a 12 to 24-month horizon. The market is slow to shed the perception of TME as a "volatile social stock." It will take several quarters of consistent subscription compounding and capital returns for the valuation multiple to re-rate closer to its global peers.

References

- Tencent Music Entertainment Group 2025 Third Quarter Earnings Conference Call Millicent T., Accessed January 25, 2026, https://filecache.investorroom.com/mr5ir_tencentmusic/441/download/TME%20Transcript%203Q25.pdf

- 3Q25 TME Investor Presentation | PDF | Securities (Finance) | Streaming Media - Scribd, Accessed January 26, 2026, https://www.scribd.com/document/956607259/3Q25-TME-Investor-Presentation

- What is Growth Strategy and Future Prospects of Tencent Music Entertainment Company?, Accessed January 26, 2026, https://portersfiveforce.com/blogs/growth-strategy/tencentmusic

- Tencent Music Entertainment Group Investor Presentation, Accessed January 26, 2026, https://filecache.investorroom.com/mr5ir_tencentmusic/405/download/1Q24%20TME%20Investor%20Presentation.pdf

- Tencent Music Entertainment Group Announces Third Quarter 2025 Unaudited Financial Results, Accessed January 27, 2026, https://ir.tencentmusic.com/2025-11-12-Tencent-Music-Entertainment-Group-Announces-Third-Quarter-2025-Unaudited-Financial-Results

- Investment analysis of Tencent Music Entertainment Group | Freedom24, Accessed January 27, 2026, https://freedom24.com/ideas/details/19843

- What is Competitive Landscape of NetEase Cloud Music Company? - MatrixBCG.com, Accessed January 27, 2026, https://matrixbcg.com/blogs/competitors/music

- Latest Posts - Soda Streaming from Douyin - Musicinfo, Accessed January 30, 2026, https://musicinfo.io/blog/soda-streaming-from-douyin

- Tencent Music Entertainment Group (TME) Investor Relations, Earnings Summary & Outlook, Accessed January 30, 2026, https://quartr.com/companies/tencent-music-entertainment-group_6030

- Tencent Music beats Q4 2024 expectations, announces dividend and share buyback, Accessed January 29, 2026, https://www.investing.com/news/earnings/tencent-music-beats-q4-expectations-announces-dividend-and-share-buyback-93CH-3933330

- Tencent Music Q4 2024 Earnings Up; To Buy Back Up To $1 Bln Shares | Nasdaq, Accessed January 29, 2026, https://www.nasdaq.com/articles/tencent-music-q4-earnings-buy-back-1-bln-shares

- Tencent Music Entertainment Group Market Cap 2018-2025 | TME - Macrotrends, Accessed January 30, 2026, https://www.macrotrends.net/stocks/charts/TME/tencent-music-entertainment-group/market-cap